(The Center Square) – The extension of the income tax deadline for Georgia taxpayers drove down state revenues for April, according to the latest numbers released by Gov. Brian Kemp’s office on Monday.

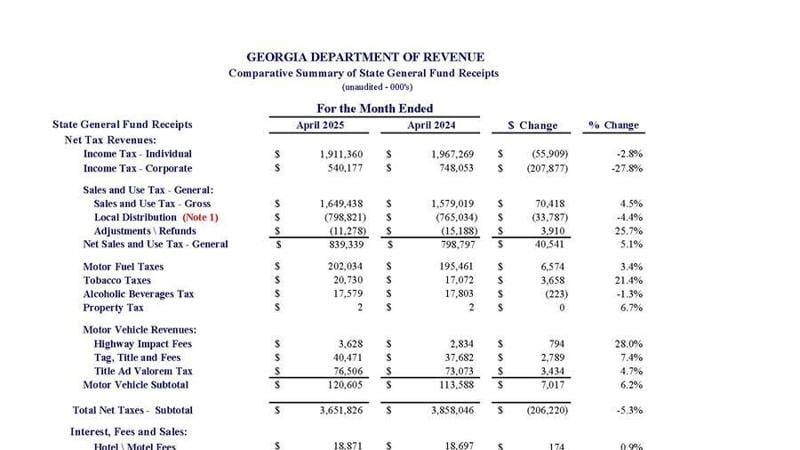

Net tax collections dropped by $230.4 million, a 5.8% decrease from April of last year. The state collected $3.73 billion in April 2025 compared to $3.96 billion in April of 2024, according to the Georgia Department of Revenue.

The governor extended the income tax filing deadline from April 15 to May 1 to help businesses and individuals affected by Hurricane Helene, which swept through the state last September. The deadline was the same even for Georgians not affected by the hurricane.

Corporate tax collections took the most significant hit, down 27.8% when compared to fiscal year 2024. Individual income tax collections were only down slightly from $1.97 billion in FY2024 to $1.91 billion in FY2025, a 2.8% reduction.

Other tax collections were up in April with sales and use tax collections up 4.5%, motor fuel taxes increasing 3.4% and motor vehicle tag and title fees rising by 7.4%, according to the report.

Year-to-date tax collections are $27.7 billion, an increase of $312 million. A moratorium on motor fuel excise tax in fiscal year 2024 accounted for the higher numbers, according to the revenue department. Without the motor fuel tax changes, year-to-date collections are down 0.6%, a $154.2 million decrease.